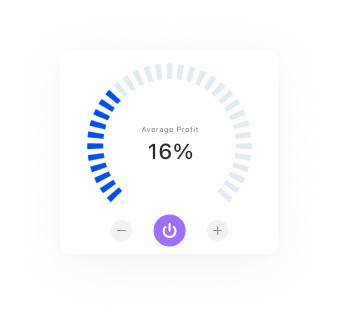

We analyze 1,000+ mutual funds and select the best performing ones using our proprietary system.

Retirement Plan Portfolio – Secure Tomorrow, Starting Today

A thoughtfully designed mutual fund portfolio to help you retire with peace of mind. Whether you're decades away or nearing retirement, this plan grows your savings while protecting your future.

Fund reviews

Funds Managed

Books Sold

Customer Satisfaction

What We Are Offering

Investment Framework

Life-Stage Based Asset Allocation: We adjust your mix of equity and debt based on how close you are to retirement.

Fund Selection for Long-Term Stability: Only time-tested mutual funds with consistent long-term performance make it to your portfolio.

Inflation-Proof Planning: We account for inflation to ensure your future purchasing power remains intact.

Corpus Projection Tools: We estimate how much you’ll need and how much you should invest now to reach that goal.

Quarterly Health Check: We monitor growth, suggest course corrections, and guide you as retirement approaches.

Value Proposition

Planning for retirement isn’t just about saving money—it’s about knowing how much to save, where to invest, and how to stay on track. Our Retirement Plan Portfolio takes the guesswork out of the equation. With customized mutual fund strategies, regular reviews, and personalized support, we help you build a secure and predictable financial future—so you can enjoy life without worrying about money.

Why choose CapiTree Asset?

Unbiased & Transparent

Always unbiased and transparent information provided to everyone

Free of cost doubts clearing session

To help the individuals better understand risks & opportunities in financial instruments.

Knowledge Based

Knowledge based content in a very simplified language

Priority Methadology

India specific proprietary methodologies & framework for stock (FIVE - G) and mutual fund research

Always Updated

We focus on providing latest and updated information

Pocket Friendly

No commission or hidden charges of any sort, pocket friendly pricing

Features

Our Process

-

1. Research & Selection

-

2. Risk Mapping

We align funds to match the risk profile of the Leader Portfolio (moderately aggressive).

-

3. Allocation & Diversification

Funds are spread across various sectors and categories to reduce risk and boost returns.

-

4. Continuous Monitoring

We track performance monthly and rebalance the portfolio every 3 months.

-

5. Transparent Reporting

You receive clear updates and reports every quarter via email or dashboard.

Testimonials

Love from Clients

After seeing so many frauds on Telegram groups and fake stock tips, I was very hesitant to trust anyone with my money. But Capitree Asset proved to be a genuine,…

My relatives and I had lost money earlier by following shady Telegram channels. Ever since I’ve shifted to Capitree Asset, I’ve found peace of mind. Their advisors give reason-backed stock…

With so many fraudsters giving tips and luring people on WhatsApp and Telegram, I wanted a SEBI-compliant advisor. Capitree Asset came as a relief. Their team is approachable, knowledgeable, and…

Build a Retirement You Can Count On

Start your journey today with a customized portfolio that grows with you and secures your future.

The future is fast approaching, and the consumer industry is on the precipice of dramatic change

Quick Links

Subscribe Newsletter

To add complexity, this is happening against a back drop of significant challenges

In case of any queries, please write to us at info@capitreeasset.com or call us at +91 92208 68603. For grievances or complaints, please contact us at grievance@capitreeasset.com. You may also lodge complaints on the SEBI SCORES platform via the SCORES website or by downloading the SEBI SCORES app from the Play Store or App Store. SCORES allows investors to file complaints against SEBI-registered intermediaries and track their status online.

SMART ODR Portal: https://smartodr.in/login

Registered Communication Address: G6HC+44P, Saket District Centre, District Centre, Sector 6, Pushp Vihar, New Delhi, Delhi 110017

SEBI Regional Office: SEBI Bhavan II, Plot No. C-7, ‘G’ Block, Bandra Kurla Complex, Bandra (E), Mumbai – 400051, Maharashtra. Tel: +91-22-26449000 / 40459000

Disclaimer

Registration granted by SEBI, membership of BASL (in the case of Investment Advisors), and certification from NISM do not in any way guarantee performance or assure returns. Investments are subject to market risks. Please read all relevant documents carefully before investing.

Why CapiTree?

At CapiTree Asset Management, we empower investors with personalized, transparent, and research-backed financial advisory services. Whether it's mutual funds, equity, debt planning, or insurance, our SEBI-registered experts work to craft smart financial strategies aligned with your goals.

We combine deep expertise, advanced analytics, and ethical practices to ensure your financial future is in safe hands. At CapiTree, we don’t just offer advice — we offer clarity, confidence, and commitment.

Join CapiTree today — where your financial growth takes root.

Copyright © 2025 CapiTree Asset LLP. All rights reserved.

- Login

- Sign Up